Baladna, the proposed holding entity of Qatar’s dominant dairy farm, is aiming to raise as much as QR1.43bn by offering 75% equity stake to public in its Initial Public Offering (IPO), it was announced on Thursday.

The offering provides eligible investors the opportunity to invest in Baladna Food Industries (BFI), Qatar's beacon of self-sufficiency in the dairy sector, through the new holding company Baladna.

The shares are being offered at QR1.01 per piece. The offer is open from October 26 to November 7. Baladna is expected to be listed on the Qatar Stock Exchange by the second week of December this year.

The founding shareholders will transfer 100% of the issued share capital (1.9bn) of BFI to the company upon its final incorporation. In return, the founders will receive, 25% of the share capital of the new holding company.

Of the 75% offer, as much as 52% is for eligible local retail investors and corporates and 23% for the strategic investors as General Retirement and Social Insurance Authority (10%), Hassad Food (5%), Al Meera (4%), and Mwani Qatar and Widam Food (2% each).

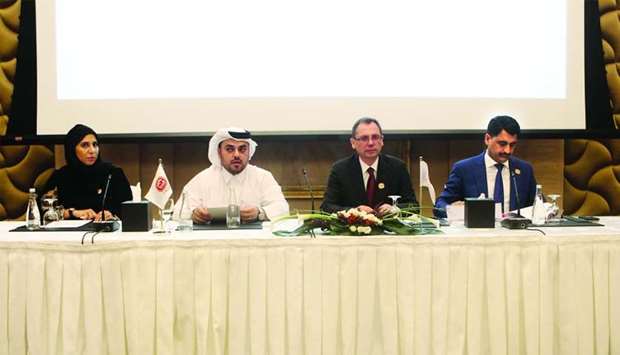

"The time is ripe for this IPO, which reflects Baladna’s commitment to provide the highest value to consumers by continuing to share its successes with the community. BFI already enjoys an unparalleled position in Qatar as a market leader with growing exports and increasing economies of scale, a robust financial basis and continuing company support," Baladna vice chairman Ramez al-Khayyat told reporters here on Thursday.

He said the proceeds from the maiden offer will be used to strengthen the financial position and meet future investments.

BFI, which so far invested QR2.9bn, has its own plastic factory and on-site packaging/bottling plants, a water treatment facility to meet farm operation needs, a feed storage facility with a six-month reserve capacity, and the most advanced milking parlour in the region.

Saifullah Khan, chief financial officer of Baladna Food Industries, said “since the company will not be having more investments in capex (capital expenditure), there will be more room for profitability and returns for investors in the future.”

The IPO prospectus is available from its offices, the lead receiving bank (QNB) throughout its branch network, as well as selected receiving banks as QNB, Ahli Bank, Doha Bank, Masraf Al Rayan, Qatar Islamic Bank, QIIB, Commercial Bank, Barwa Bank and al khaliji. The lead banks are expected to provide financing to Qatari individuals wishing to subscribe to the IPO.

On the exports, al-Khayyat said the company products have lot of demand and been getting requests from many countries in North Africa and Asia, including Malaysia. BFI has already entered into an agreement with Felcra on the sidelines of the Qatari-Malaysian Joint Trade Committee in Kuala Lumpur.