Lebanese banks planning to reopen soon will act together for the first time to take emergency measures on the movement of capital amid continuing political turmoil.

Calling the steps temporary, banks agreed to lift a restriction on new money coming from abroad and set a withdrawal limit of $1,000 a week for accounts denominated in foreign currency, according to a statement issued Sunday by the Association of Banks in Lebanon. Lenders also said that the transfer of funds outside the country will be allowed strictly for urgent personal matters and asked clients to use their credit cards to meet their needs.

The association insisted the curbs don’t amount to capital controls and are being rolled out in co-ordination with the central bank. They’ll go into effect when lenders reopen for business, possibly as early today.

Even before the latest round of restrictions, however, S&P Global Ratings was warning about “unofficial capital controls imposed by banks,” which it blamed for hurting confidence. Analysts say the measures taken by lenders – both at the outset of the crisis and the most recent ones – effectively put limits on the movement of money. Central bank governor Riad Salameh has said that officially sanctioned capital controls weren’t being considered.

Banks have been closed for much of the past month, a period of unprecedented disruption even in a country that’s endured war and political strife, as anti-government protests took hold nationwide. Their employees went on strike last week, urging management to provide them with more security in the face of angry clients who sought to withdraw money.

Lenders were set to meet the union yesterday to discuss the security precautions agreed on with the Interior Ministry.

The central bank’s governor asked lenders earlier this month to ease some of the restrictions they imposed, meant to prevent capital flight and avoid a run on the banks. The measures have stymied imports, with suppliers of fuel and medical products warning of shortages because of a lack of foreign exchange. That’s forced them to buy dollars at money changers that were pricing them higher than the official fixed exchange rate.

Salameh also asked banks to raise their capital by 20% by next June and refrain from distributing dividends for 2019 to boost their liquidity and prepare for possible credit downgrades.

S&P downgraded three top banks in Lebanon last week, warning that the country’s economic crisis is draining liquidity from lenders. The company said it would further lower the ratings should there be “additional pressure on banks’ liquidity positions or if the banks impose further restrictions on specific transfers and operations.”

Prime Minister Saad Hariri resigned last month due to protests and President Michel Aoun has yet to set a date for parliamentary talks to name a new premier. Major political parties nominated a wealthy businessman to lead the cabinet but he withdrew his candidacy after a backlash from protesters who are seeking a government of experts to lead the country out of the crisis.

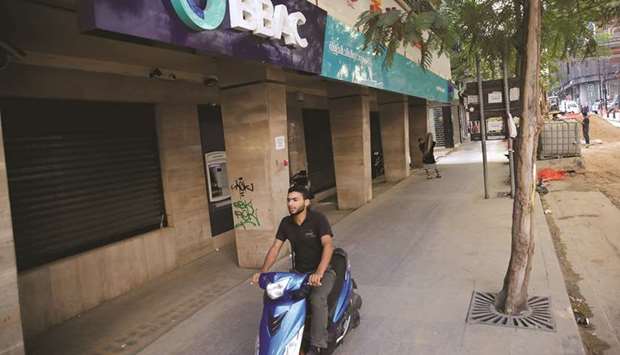

A man drives a motorbike past a closed bank office in Beirut on November 15. Lebanese banks planning to reopen soon will act together for the first time to take emergency measures on the movement of capital amid continuing political turmoil.